Welcome to Module 1! This is the beginning of an exciting journey where you’ll explore the 4 retirement phases and uncover the unique opportunities and challenges each phase brings. As you move through this module and beyond, one thing will become crystal clear: time is your most precious asset.

As you dive deeper into the Module 1 Assessments and reflect on the questions posed, you may encounter feelings of regret. But here’s the empowering truth: regret is simply a signal that an opportunity was missed, and it’s a powerful tool for growth. Imagine for a moment, if you could turn back time and make a different decision. What would you change?

Now, take it a step further: what if you could fast forward and shape your present to create the future you desire?

Throughout the next four modules, you’ll reflect on your past, present, and future across all four phases of retirement. More importantly, you’ll craft a plan that’s uniquely yours—one that aligns with your deepest values and priorities. This plan will be your No Regrets Plan, designed to fuel you with the passion and purpose to prioritize your time, energy, and resources in ways that matter most to you.

Here’s a quick, powerful exercise: Imagine you have just 2 years to live. Your health is great, but you only have 24 months left. What would you do with that time? Take a moment to write it down. For many, this is a wake-up call to shift focus from the urgent to the truly important. If that resonates with you, use this as motivation to begin making the necessary changes.

While you’re reflecting on priorities, take a moment to envision your perfect retirement day and week. What does that look like? Writing it down will help you clarify your goals and begin shaping your reality.

Remember, priorities evolve over time, and that’s completely natural. To succeed in every phase of retirement, you must be flexible and revisit your plan regularly. Your plan will include short-term, mid-term, and long-term goals, with regular reviews to ensure you stay aligned with your evolving priorities. Life happens, and circumstances change, but maintaining your No Regrets Plan will keep you grounded and focused on your bigger vision.

Now, let’s get started. Click below to record your insights and actions as you complete Module 1. This is your first step toward a future filled with purpose, confidence, and no regrets!

Housekeeping note: At Leap Retirement Coaching, many of the forms are editable PDF. If editing on phone, you may need to download the Adobe PDF Pro App (Free, no subscription needed) to enable editing. Then can save locally.

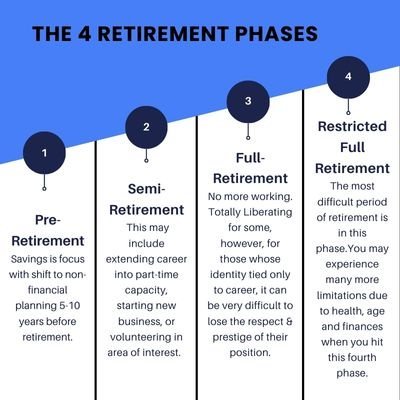

You are employed but are preparing and planning for life beyond your income earning years. Ideally started savings in your 30’s and at the latest in your early 40’s. By the time you reach your mid to late 50’s, you should be financially well prepared for your future.

In your late 40’s and early 50’s, this is the time to get serious about your vision for the non financial side of retirement. Ideally allow yourself at least 5-10 years before your semi-or full retirement to start laying the groundwork for the non-financial side of retirement. Take the Leap Retirement Coaching Pre-Retirement Quiz below.

Semi-retirement basically means working part-time in some capacity. This may include extending career into part-time capacity, starting new business, or volunteering in area of interest. It is very common for those with high incomes and or levels of education to spend more time in this phase than phase 3 & 4, probably because they derive satisfaction or identity from their work.

Doing some type of work or structured volunteering is good for your emotional, financial and physical health. Some social science literature indicates seniors who work and volunteer later in life live longer than peers. It is possible to stay in phase 2 for a very long time. Perhaps so long you may only spend days in phase 3 and 4. Average age in phase 2 is 67.

The Part Time work assessment will clarify if working into retirement makes sense for you, and if so the type of work, environment, and frequency that fits your interests.

Click link to take the Leap Retirement Coaching Part Time Work Assessment.

No more working. Surprisingly, this phase can be much more difficult than it seemed it would be. If you have dedicated life to specific field or practice and its stops, it can bring with it a loss of identity, respect, and prestige – in other words, it can be stressful and depressing.

Those that have cultivated leisure activities over the years have a definite advantage. Developing and planning for range of activities prior to full retirement ideal, however, it is never too late to begin. Average age in phase 3 is 72.

Click the link to take the Leap Retirement Coaching Full Retirement Assessment.

You may experience many more limitations due to health, age and finances when you hit this fourth phase. Without a doubt, the most difficult period of retirement is in this phase. Adversity may come at you in waves. Women often weather this period better than men. Average age in phase 4 is 78. Link below is to a Legacy Journal. 58 Questions for documenting life experiences to share with future generations.

It is important to remember, you can move in and out of phases 1-3 as long as you remain healthy. Part time, seasonal, and contract work, starting new business, and volunteering all counted as work.

Leap Retirement Coaching has not developed an assessment for restricted full retirement, however, we offer individual coaching sessions to support this need.