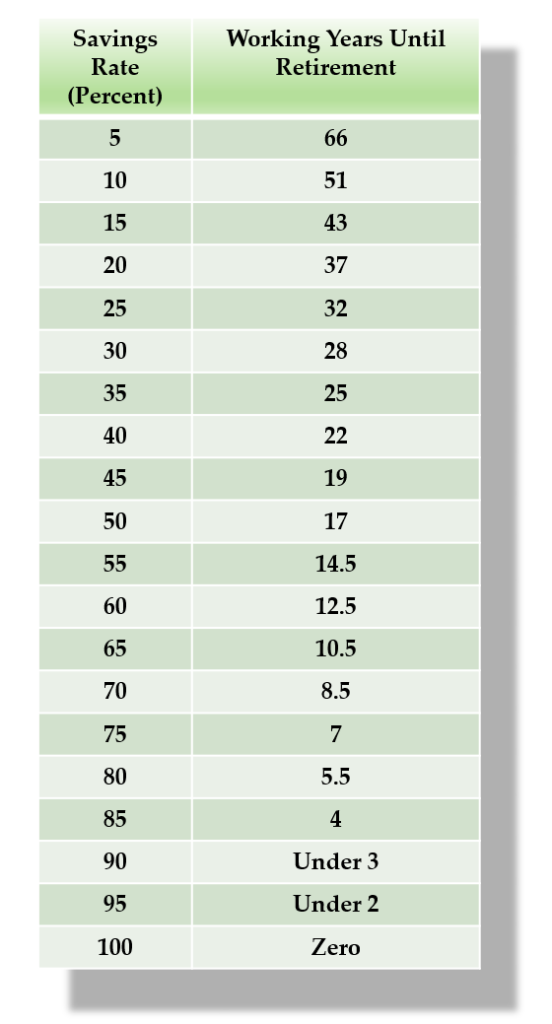

How Many Years do I Need to Work? Well, I have a surprise for you. It turns out that when you boil it down, your time to reach retirement depends on only one factor:

👉 Your savings rate, as a percentage of your take-home pay.

That’s it. If you want to dig deeper, your savings rate is simply a function of two things:

The math is surprisingly simple yet eye-opening. If you spend 100% of your income (or more), you’ll never be ready to retire unless someone else is saving for you. On the flip side, if you somehow live on 0% of your income and maintain that forever, you could retire today.

In between these extremes, something fascinating happens. The money you save doesn’t just sit there—it grows. It starts earning money on its own, and that money earns even more. This is the magic of compound growth, and when your investments generate enough to cover your living expenses, you’ve reached financial independence.

The key takeaway? The higher your savings rate, the fewer years you’ll need to work. For example, if you save 50% of your income, you could retire in just 16 years. But if you save only 10%, you’re looking at a 51-year career.

Let’s put it another way—how much of your life are you willing to exchange for things like cable TV, daily lattes, or an oversized house?

If cutting a few small luxuries could mean retiring years or even decades earlier, would you make that trade?

Most people assume that the key to retiring early is making more money. But the reality is that cutting expenses is far more powerful. Why? Because every dollar you stop spending does two things:

How Many Years Do I Need to Work? Now, let’s make this real. Take a few minutes to do this:

The formula is right in front of you. Want to retire in 10 years? Live on 35% of your take-home pay. The only question is—how badly do you want it?

Now, what’s your number? Let me know in the comments!